PROPERTY505

To Start growing your rental portfolio today, hit the button below!

When I first met my wife, she lived in London and I lived in Suffolk. I would travel as often as I could to see her, and the road that connected us was the A505 past Royston. I remember making that journey with excitement and anticipation every time, which is very similar to the excitement you feel investing in property for the first time.

My wife and I started this company together, and I wanted the name to be meaningful to both of us. So we chose Property505.

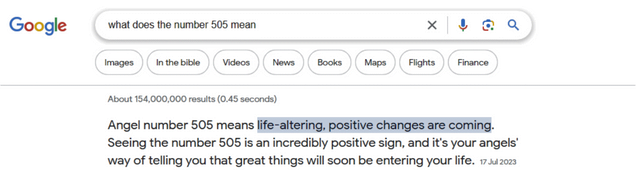

Then, when I googled the number 505, I found this wonderful response:

The mission of Property505 is echoed in these exact words, as this is what our services do for our clients. We change their lives for the better. I couldn’t have hoped for a more perfect fit, and so the name Property505 was born.

Yes, you will typically have an interest only Buy-to-Let mortgage to the value of 75% of the value of the property.

Why interest only you may ask? Because you want to maximise your cash flow and therefore paying off the principal isn’t in your best interests. You will also want to remortgage in 5-6 years and release the equity that has built up over time so that you can buy more properties. If you are going to release equity in the future anyway it makes little sense to reduce your cash flow in the short term.

At the end of the program, you will own the property through a limited company.

Please note that I am not a licensed financial advisor or accountant, and I always recommend seeking professional advice when considering the tax implications of owning property.

Owning property through a limited company is widely accepted to be the most tax-efficient method. This is because you are exempt from Section 24 tax, which affects private landlords. Section 24 tax means that private landlords are taxed on the full rental income of the properties they own, without being able to offset their mortgage payments as deductible expenses.

For example, if you rent out a property for £1,000 per month and your mortgage is £500 per month, you will pay tax on the full £1,000 income as a private landlord. However, if you own the property through a limited company, you will only pay tax on the profits, which is £500 per month less insurances and fees.

Another significant advantage of owning property through a limited company arises when you have additional income that pushes you into a higher tax bracket. If you hold the property in your own name and you’re already earning more than £50,000/year, you’ll be subject to higher income tax rates (40% or 45%) on your rental income. However, with a limited company, you only pay corporation tax, which starts at a lower rate of 19% of profits.

We Respect Your Privacy. Your Information Will Never Be Shared

We Respect Your Privacy. Your Information Will Never Be Shared

We Respect Your Privacy. Your Information Will Never Be Shared

We Respect Your Privacy. Your Information Will Never Be Shared